PROPOSALS

Proposal 1 : Revise the fundamental policy relating to borrowing. |

Proposed Policy: The Fund may not borrow money except as permitted by (i) the 1940 Act and the rules and regulations thereunder, or other successor law governing the regulation of registered investment companies, or interpretations or modifications thereof by the SEC, SEC staff or other authority of competent jurisdiction, or (ii) exemptive or other relief or permission from the SEC, SEC staff or other authority of competent jurisdiction. |

| Funds Affected: | Current Policy: |

The Value Line Fund, Inc. Value Line Income and Growth Fund, Inc. Value Line Premier Growth Fund, Inc. | The Fund may not borrow money in excess of 10% of the value of its assets and then only as a temporary measure to meet unusually heavy redemption requests or for other extraordinary or emergency purposes. Securities will not be purchased while borrowings are outstanding. No assets of the Fund may be pledged, mortgaged or otherwise encumbered, transferred or assigned to secure a debt except in connection with the Fund’s entering into stock index futures. |

| Value Line Larger Companies Fund, Inc. | The Fund may issue evidences of indebtedness but only from banks and only if the value of the Fund’s assets, less its liabilities other than borrowings, is equal to at least 300% of all borrowings including the proposed borrowing. |

Value Line Centurion Fund, Inc. Value Line Strategic Asset Management Trust | The Fund may not borrow money, except that the Fund may (a) enter into commitments to purchase securities and instruments in accordance with its investment program, including when-issued and delayed-delivery transactions, and reverse repurchase agreements, provided that the total amount of any borrowing does not exceed 10% of the Fund’s total assets at the time of the transaction; and (b) borrow money in an amount not to exceed 10% of the value of its total assets at the time the loan is made. Borrowings representing more than 10% of a Fund’s total assets must be repaid before the Fund may make additional investments. |

| Value Line Core Bond Fund | The Fund may not borrow money in excess of 10% of the value of its assets and then only as a temporary measure to meet unusually heavy redemption requests or for other extraordinary or emergency purposes. Securities will not be purchased while borrowings are outstanding. No assets of the Fund may be pledged, mortgaged or otherwise encumbered, transferred or assigned to secure a debt except in connection with the Fund’s entering into interest rate futures contracts and then only to the extent of one-third of its assets. |

Value Line Small Cap Opportunities Fund, Inc. Value Line Asset Allocation Fund, Inc. | The Fund may not borrow money in excess of 10% of the value of its net assets and then only as a temporary measure to meet unusually heavy redemption requests or for other extraordinary or emergency purposes. Securities will not be purchased while borrowings are outstanding. No assets of the Fund may be pledged, mortgaged or otherwise encumbered, transferred or assigned to secure a debt. |

OTHER INFORMATIONThe 1940 Act imposes certain limitations on borrowing activities of mutual funds and requires that a fund’s borrowing limitations be reflected in its fundamental policies. These limitations are designed to protect mutual fund shareholders and their investments by limiting a fund’s ability to subject its assets to the claims of creditors who, under certain circumstances, might have a claim to the fund’s assets that would take precedence over the claims of shareholders. The restrictions are also designed to limit a fund’s ability to leverage its assets.

Share Ownership of DirectorsUnder the 1940 Act, a mutual fund may borrow only from banks, and Management.

As of July 31, 2010, the percentage of shares of each Fund beneficially owned by all Directors and Nominees, each executive officer of the Funds, and by the Directors and officers of the Funds (as a group) was not more than 1% of the Funds.

Other Matters.

There have been no material legal proceeding, pending or otherwise, against any Director or Nominee during the past ten years.

There is no arrangement or understanding in connection with the New Investment Advisory Agreements with respect to the composition of the Board , the Adviser or the restructured Adviser with respect to the selection or appointment of any person to any office with either the Funds , the Adviser or the restructured Adviser.

There are no material pending legal proceedings to which any Director or Nominee or affiliated person of such Director or Nominee is a party adverse to the Funds or any of their affiliated persons or has a material interest adverse to the Fund or any of its affiliated persons. Legal proceedings are material only to the extent that theythe value of the fund’s assets less its liabilities (excluding other borrowings) is equal to at least 300% of all borrowings (including the proposed borrowing). One of the reasons that mutual funds typically borrow money is to meet redemptions or for other short-term cash needs in order to avoid forced, unplanned sales of portfolio securities. Such borrowings allow a fund greater flexibility by allowing its investment adviser to buy and sell portfolio securities primarily for investment or tax considerations, rather than for temporary cash flow considerations. In addition, a fund may borrow up to 5% of its total assets for temporary purposes from banks or other lenders.

The Funds are likelysubject to a number of different fundamental investment policies concerning borrowing that generally are more restrictive than required by the 1940 Act. The current policies typically do one or more of the following: restrict a Fund to borrowing only from banks and/or for temporary purposes; limit a Fund’s borrowing to 10% of its assets; prohibit a Fund from making an investment if aggregate margins and premiums on futures contracts exceed 5% of assets; limit or prohibit a Fund from pledging assets to secure debts; prohibit a Fund from borrowing for investment or leverage purposes; and/or specify that certain trading practices and investments will or will not be treated as borrowing.

The Proposed Policy would permit the Funds to borrow money, and to engage in trading practices that may be considered to be borrowing, to the fullest extent permitted by the 1940 Act or any rule, exemption or interpretation thereunder issued by an appropriate authority. By revising the existing policy, a Fund would not be unduly limited if the Adviser determines that borrowing is in the best interests of a Fund and its shareholders. To the extent that a Fund uses the borrowing flexibility, the Fund may be subject to some additional costs and risks inherent to borrowing, such as reduced total return and increased volatility. The additional costs and risks to which the Fund may be exposed are limited, however, by the borrowing limitations imposed by the 1940 Act and any other applicable law, rule, exemption or interpretation thereof.

The Adviser has advised the Board that the proposed revisions to the fundamental policy on borrowing are not expected to materially affect the manner in which any Fund’s investment program is being conducted at this time, as reflected in the Fund’s current prospectus and statement of additional information. Before a material change is made in a Fund’s investment strategies in response to this revised policy, the Board will be consulted and the Fund’s prospectus or statement of additional information will be revised to disclose the change, the purpose of the changed strategy and, as applicable, any additional risks.

The Board recommends that you vote “FOR” this Proposal.

Proposal 2A : Revise the fundamental policy relating to concentration of investments. |

Proposed Policy: Except as permitted by (i) the 1940 Act and the rules and regulations thereunder, or other successor law governing the regulation of registered investment companies, or interpretations or modifications thereof by the SEC, SEC staff or other authority of competent jurisdiction, or (ii) exemptive or other relief or permission from the SEC, SEC staff, or other authority of competent jurisdiction, the Fund may not purchase the securities of any issuer if, as a result of such purchase, the Fund’s investments would be concentrated in any particular industry. |

| Funds Affected: | Current Policy: |

The Value Line Fund, Inc. Value Line Income and Growth Fund, Inc. Value Line Premier Growth Fund, Inc. Value Line Larger Companies Fund, Inc. Value Line Centurion Fund, Inc. Value Line Core Bond Fund Value Line Small Cap Opportunities Fund, Inc. Value Line Asset Allocation Fund, Inc. | The Fund may not invest 25% or more of its assets in securities of issuers in any one industry. |

| Value Line Strategic Asset Management Trust | The Trust may not invest 25% or more of its assets in securities of issuers in any one industry. For the purpose of this restriction, gas, electric, water and telephone utilities will each be treated as a separate industry. |

Proposal 2B : Reclassify the additional policy relating to concentration as non-fundamental. |

Funds Affected: | Current Policy: |

The Value Line Fund, Inc. Value Line Income and Growth Fund, Inc. Value Line Premier Growth Fund, Inc. Value Line Larger Companies Fund, Inc. Value Line Centurion Fund, Inc. Value Line Core Bond Fund Value Line Strategic Asset Management Trust Value Line Small Cap Opportunities Fund, Inc. Value Line Asset Allocation Fund, Inc. | For purposes of industry classifications, the Fund follows the industry classifications in The Value Line Investment Survey. |

The 1940 Act requires all mutual funds to have a material adverse effectfundamental policy regarding the concentration of their investments in a particular industry or group of industries. The SEC takes the positions that (i) investment of more than 25% of a fund’s total assets in one or more issuers conducting their principal activities in the same industry or group of industries constitutes concentration, and (ii) the 25% limit does not apply to U.S. Government securities. Accordingly, a fund may not invest more than 25% of its total assets in securities of issuers in any particular industry (except for U.S. Government securities) unless it makes appropriate disclosures in its registration statement. Although the policy of concentrating or not concentrating must be fundamental, there is no requirement that such policy specify the percentage threshold or industry definitions that a fund will use in applying its concentration policy. A fund may simply state that it will or will not concentrate.

Currently, each Fund has a fundamental policy that specifies it will not invest more than 25% of assets in any industry. Each Fund also has a fundamental policy that it will use the Value Line Investment Survey’s industry classifications in determining the industry of an issuer. Since there are two existing fundamental policies involved, two separate shareholder votes are required. Accordingly, shareholders of each Fund are being asked to change one policy to the new fundamental policy (Proposal 2A ), and to reclassify the other policy (Proposal 2B ).

If shareholders approve Proposal 2A , references to a stated 25% industry limit as part of a Fund’s concentration policy will be eliminated in favor of the Proposed Policy, which does not contain a stated percentage limitation but instead refers to concentration as it may be determined from time to time by the SEC or other appropriate authorities. If shareholders approve Proposal 2B , each Fund’s policy of relying on the FundsValue Line Investment Survey’s industry classifications will be reclassified as non-fundamental. This reflects a more modernized approach to industry concentration, and provides each Fund with investment flexibility that ultimately is expected to help the Fund respond to future legal, regulatory, market, or th e abilitytechnical changes.

The Adviser has advised the Board that the proposed revisions to the fundamental policy on concentration are not expected to materially affect the manner in which any Fund’s investment program is being conducted at this time, as reflected in the Fund’s current prospectus and statement of additional information. Before a material change is made in a Fund’s investment strategies in response to this revised policy, the Board will be consulted and the Fund’s prospectus or statement of additional information will be revised to disclose the change, the purpose of the restructuredchanged strategy and, as applicable, any additional risks.

The Board recommends that you vote “FOR” these Proposals.

Proposal 3 : Revise the fundamental policy relating to lending. |

Proposed Policy: The Fund may not make loans except as permitted by (i) the 1940 Act and the rules and regulations thereunder, or other successor law governing the regulation of registered investment companies, or interpretations or modifications thereof by the SEC, SEC staff or other authority of competent jurisdiction, or (ii) exemptive or other relief or permission from the SEC, SEC staff, or other authority of competent jurisdiction. |

| Funds Affected: | Current Policy: |

The Value Line Fund, Inc. Value Line Income and Growth Fund, Inc. Value Line Premier Growth Fund, Inc. Value Line Larger Companies Fund, Inc. | The Fund may not lend money except in connection with the purchase of debt obligations or by investment in repurchase agreements, provided that repurchase agreements maturing in more than seven days when taken together with other illiquid investments do not exceed 10% of the Fund’s assets. |

| Value Line Centurion Fund, Inc. | The Fund may not lend money except in connection with the purchase of debt obligations or by investment in repurchase agreements. |

| Value Line Core Bond Fund | The Fund may not lend money except in connection with the purchase of debt obligations or by investment in repurchase agreements, provided that repurchase agreements maturing in more than seven days when taken together with other illiquid investments do not exceed 10% of the Fund’s assets. The Fund may lend its portfolio securities to broker-dealers and institutional investors if as a result thereof the aggregate value of all securities loaned does not exceed 331/3% of the total assets of the Fund. |

| Value Line Strategic Asset Management Trust | The Trust may not lend money except in connection with the purchase of debt obligations or by investment in repurchase agreements. The Trust may lend its portfolio securities to broker-dealers and institutional investors if as a result thereof the aggregate value of all securities loaned does not exceed 33 1/3% of the total assets of the Trust. |

Value Line Small Cap Opportunities Fund, Inc. Value Line Asset Allocation Fund, Inc. | The Fund may not lend money except in connection with the purchase of debt obligations or by investment in repurchase agreements, provided that repurchase agreements maturing in more than seven days, over-the-counter options held by the Fund and the portion of the assets used to cover such options when taken together with other securities that are illiquid or restricted do not exceed 15% of the Fund’s net assets. The Fund may lend its portfolio securities to broker-dealers and institutional investors if as a result thereof the aggregate value of all securities loaned does not exceed 33 1/3% of the total assets of the Fund. |

The 1940 Act requires mutual funds to have a fundamental policy about making loans. SEC staff interpretations prohibit mutual funds from lending more than one-third of their total assets, except through investments in debt obligations and repurchase agreements (which are often treated as loans by the SEC). In addition, under SEC staff interpretations, lending by a mutual fund, under certain circumstances, may also give rise to issues relating to the issuance of senior securities. In these circumstances, the fund would be subject to limitations imposed under the 1940 Act regarding the issuance of senior securities as well as lending. (See Proposal 5 below.)

The Funds’ current fundamental policies on lending vary greatly. The current policies generally prohibit the making of loans, but specify that certain investments and practices either are not subject to that prohibition (in full or in part) or do not constitute the making of loans. Such investments and practices include: purchasing debt obligations; entering into repurchase agreements; lending securities; using collateral arrangements with respect to options, forward currency and futures transactions, and other derivative instruments; and delays in the settlement of securities transactions.

If this Proposal is approved, the Funds will be permitted to lend money and other assets to the fullest extent permitted by the 1940 Act as interpreted from time to time. The Proposed Policy will be interpreted so as not to prevent or limit a Fund from engaging in the types of investments and practices indicated above that might be considered lending. The Proposed Policy also gives the Fund the greatest amount of flexibility to loan portfolio securities to generate income within the limits of the 1940 Act where desirable and appropriate in accordance with their investment objectives.

The Adviser has informed the Board that the proposed revision to perform itsthe fundamental policy on lending is not expected to materially affect the manner in which any Fund’s investment program is being conducted at this time, as reflected in the Fund’s current prospectus and statement of additional information. Before a material change is made in a Fund’s investment strategies in response to this revised policy, the Board will be consulted and the Fund’s prospectus or statement of additional information will be revised to disclose the change, the purpose of the changed strategy and, as applicable, any additional risks.

The Board recommends that you vote “FOR” this Proposal.

Proposal 4A : Revise the fundamental policy relating to real estate and commodities. |

Proposed Policy: The Fund may not purchase or sell commodities or real estate except as permitted by (i) the 1940 Act and the rules and regulations thereunder, or other successor law governing the regulation of registered investment companies, or interpretations or modifications thereof by the SEC, SEC staff or other authority of competent jurisdiction, or (ii) exemptive or other relief or permission from the SEC, SEC staff, or other authority of competent jurisdiction. |

| Funds Affected: | Current Policy: |

The Value Line Fund, Inc. Value Line Income and Growth Fund, Inc. Value Line Premier Growth Fund, Inc. Value Line Larger Companies Fund, Inc. Value Line Core Bond Fund | The Fund may not purchase securities of other investment companies or invest in real estate, mortgages or illiquid securities of real estate investment trusts although the Fund may purchase securities of issuers which engage in real estate operations. |

Value Line Centurion Fund, Inc. Value Line Strategic Asset Management Trust | The Fund may not invest in real estate, mortgages or illiquid securities of real estate investment trusts although the Fund may purchase securities of issuers which engage in real estate operations. |

Value Line Small Cap Opportunities Fund, Inc. Value Line Asset Allocation Fund, Inc. | The Fund may not purchase securities of other investment companies except in mergers or other business combinations or invest in real estate, mortgages, illiquid securities of real estate investment trusts, real estate limited partnerships or interests in oil, gas or mineral leases, although the Fund may purchase securities of issuers which engage in real estate operations. |

Proposal 4B : Remove the additional fundamental policy relating to real estate and commodities. |

Funds Affected: | Current Policy: |

The Value Line Fund, Inc. Value Line Income and Growth Fund, Inc. Value Line Larger Companies Fund, Inc. Value Line Strategic Asset Management Trust | The Fund may not purchase or sell any put or call options or any combination thereof, except that the Fund may write and sell covered call option contracts on securities owned by the Fund. The Fund may also purchase call options for the purpose of terminating its outstanding obligations with respect to securities upon which covered call option contracts have been written (i.e., “closing purchase transactions”). The Fund may also purchase and sell put and call options on stock index futures contracts. |

| Value Line Premier Growth Fund, Inc. | The Fund may not purchase or sell any put or call options or any combination thereof, except that the Fund may write and sell covered call option contracts on securities owned by the Fund. The Fund may also purchase call options for the purpose of terminating its outstanding obligations with respect to securities upon which covered call option contracts have been written (i.e., “closing purchase transactions”). |

Value Line Premier Growth Fund, Inc. Value Line Centurion Fund, Inc. | The Fund may not invest in commodities or commodity contracts. |

The Value Line Fund, Inc. Value Line Income and Growth Fund, Inc. Value Line Premier Growth Fund, Inc. Value Line Larger Companies Fund, Inc. | In addition, management of the Fund has adopted a policy that it will not recommend that the Fund purchase interest in oil, gas or other mineral type development programs or leases, although the Fund may invest in the securities of companies which operate, invest in or sponsor such programs. |

The Value Line Fund, Inc. Value Line Income and Growth Fund, Inc. Value Line Larger Companies Fund, Inc. Value Line Strategic Asset Management Trust | The Fund may not invest in commodities or commodity contracts except that the Fund may invest in stock index futures contracts and options on stock index futures contracts. |

| Value Line Centurion Fund, Inc. | The Fund may not write, purchase or sell any put or call options or any combination thereof. |

| Value Line Core Bond Fund | The Fund may not invest in commodities or commodity contracts except that the Fund may enter into interest rate futures contracts. The Fund may not purchase oil, gas or other mineral type development programs or leases, except that the Fund may invest in the securities of companies which invest in or sponsor such programs. The Fund may not purchase or sell any put or call options or any combination thereof, except that the Fund may (a) purchase, hold and sell options on contracts for the future delivery of debt securities and warrants where the grantor of the warrants is the issuer of the underlying securities, and (b) write and sell covered call option contracts on securities owned by the Fund. The Fund may also purchase call options for the purpose of terminating its outstanding obligations with respect to securities upon which covered call option contracts have been written (i.e., “closing purchase transactions”). The Fund may not enter into an interest rate futures contract if, as a result thereof, (i) the then current aggregate futures market prices of financial instruments required to be delivered under open futures contract sales plus the then current aggregate purchase prices of financial instruments required to be purchased under open futures contract purchases would exceed 30% of the Fund’s total assets (taken at market value at the time of entering into the contract) or (ii) more than 5% of the Fund’s total assets (taken at market value at the time of entering into the contract) would be committed to margin on such futures contracts plus premiums on options on futures contracts. |

Value Line Small Cap Opportunities Fund, Inc. Value Line Asset Allocation Fund, Inc. | The Fund may not invest in commodities or commodity contracts except that the Fund may invest in futures contracts and financial futures contracts and options on futures contracts and financial futures contracts. |

The 1940 Act requires all mutual funds to have fundamental policies governing their investments in commodities and real estate. The 1940 Act permits investments in physical and financial commodities and real estate, as well as companies investing in such commodities and real estate (subject to the fund remaining an investment company). SEC staff interpretations limit a mutual fund’s ability to invest in illiquid securities, which typically include real estate and many physical commodities, to no more than 15% of a fund’s net assets. With respect to financial commodities, the SEC staff takes the position that a fund’s use of options, futures and forward contracts may constitute the issuance of senior securities if the fund does not segregate cash or liquid securities in an equivalent amount or hold an offsetting commitment from another party. In these circumstances, the fund would be subject to limitations imposed under the 1940 Act regarding the issuance of senior securities as well as commodities. (See Proposal 5 below.)

Currently, all the Funds have complex fundamental and non-fundamental policies that limit or prohibit their investment in different physical and financial commodities and real estate . Many of these policies include a prohibition on the Fund investing in securities issued by other investment companies . These fundamental policies provide greater detail and more restrictions than required by the 1940 Act for commodities or real estate. With respect to the Funds’ investments in financial commodities that may qualify as senior securities, the fundamental policies are also more detailed and restrictive than required for senior securities. Regarding the prohibition on investing in securities issued by other investment companies , a fund is not required to have a fundamental policy regarding such investments. Rather, the 1940 Act imposes limits on a fund’s ability to invest in other investment companies. Certain Funds have multiple policies with respect to these items because their policy with respect to real estate and mineral type development programs is separate from the policy relating to commodities. Since there are multiple existing fundamental policies involved, separate shareholder votes are required. Accordingly, shareholders of each Fund are being asked to change one policy to the new fundamental policy (Proposal 4A ), and to eliminate the additional policies (Proposal 4B ).

The Proposed Policy will permit the Funds to invest in real estate (directly or indirectly), as well as physical and financial commodities, to the fullest extent permitted by the 1940 Act and related interpretations, as in effect from time to time. The Proposed Policy will be interpreted to not limit a Fund’s ability to invest in commodities or in commodity-related instruments, including futures contracts on interest rates, stock indices and currencies, and options thereon, as well as forward currency transactions and options on currencies. The revised policy would also preserve a Fund’s flexibility to invest in real estate, as well as real estate-related companies and companies whose business consists in whole or in part of investing in real estate. The Proposed Policy will not limit investment in exchange-traded funds that invest in physical or financial commodities. The Adviser currently intends to invest, from time to time, a portion of a Fund’s assets in other investment companies if that Fund’s shareholders approve Proposal 4A. Any such investments would not be a principal investment strategy for the Fund and would comply with the Funds.1940 Act’s limits on such investments. For example, the Adviser may invest a portion of such Fund’s assets in ETFs to quickly gain exposure to a broad index of securities in lieu of investing directly in stocks, and Funds that lend portfolio securities may invest cash collateral received from those lending arrangements in other investment companies to seek to generate income in excess of that available on other investments. Currently, the Funds re-invest such collateral in more conservative repurchase agreements, and re-investing the collateral in other investment companies could increase the risk that collateral will lose value. Investing in other investment companies also poses certain inherent risks associated with “pyramiding,” such as layering of fees that reduce a Fund’s total return. Such risks are mitigated in part by the 1940 Act’s limitations on a fund’s ability to invest in securities issued by other investment companies, which will continue to apply. Also, such a change to the manner in which a Fund is operated will only be implemented when a Fund’s prospectus and statement of additional information, as appropriate, adequately disclose the strategy and any additional risks.

The restructured Adviser provideshas advised the Board that the proposed revisions to the fundamental policy on real estate and commodities are not expected to materially affect the manner in which any Fund’s investment advisory servicesprogram is being conducted at this time, as reflected in any Fund’s current prospectus and statement of additional information. Before a material change is made in a Fund’s investment strategies in response to this revised policy, the Board will be consulted and the Fund’s prospectus or statement of additional information will be revised to disclose the change, the purpose of the changed strategy and, as applicable, any additional risks.

The Board recommends that you vote “FOR” these Proposals.

Proposal 5 : Revise the fundamental policy relating to senior securities. |

Proposed Policy: The Fund may not issue senior securities except as permitted by (i) the 1940 Act and the rules and regulations thereunder, or other successor law governing the regulation of registered investment companies, or interpretations or modifications thereof by the SEC, SEC staff or other authority of competent jurisdiction, or (ii) exemptive or other relief or permission from the SEC, SEC staff, or other authority of competent jurisdiction. |

| Funds Affected: | Current Policy: |

The Value Line Fund, Inc. Value Line Income and Growth Fund, Inc. Value Line Premier Growth Fund, Inc. Value Line Centurion Fund, Inc. Value Line Core Bond Fund Value Line Strategic Asset Management Trust | The Fund may not issue senior securities except evidences of indebtedness permitted under [the Fund’s fundamental policy regarding borrowing]. |

| Value Line Larger Companies Fund, Inc. | The Fund may not issue senior securities except evidences of indebtedness [as permitted under the Fund’s fundamental policy regarding borrowing]. |

Value Line Small Cap Opportunities Fund, Inc. Value Line Asset Allocation Fund, Inc. | The Fund may not issue senior securities. |

The 1940 Act requires mutual funds to have a fundamental policy concerning the issuance of senior securities. A senior security is an obligation of a fund that has priority over the fund’s shareholders with respect to the payment of earnings or assets. The 1940 Act prohibits an open-end fund from issuing senior securities (except for borrowings, as described in Proposal 1 ). However, SEC staff interpretations allow mutual funds under certain conditions to engage in a number of types of trading practices and investments that might otherwise be considered senior securities, including repurchase and reverse repurchase agreements, dollar rolls, when-issued and delayed-delivery transactions, short sales, options, futures and forward contracts. These staff interpretations generally provide that such transactions will not be considered senior securities under the 1940 Act if the fund segregates cash or liquid securities in an equivalent amount or holds an offsetting commitment from another party.

Currently, most of the Funds are not permitted to issue senior securities except to the extent that borrowings or certain delineated investment practices (such as purchasing securities on a delayed-delivery basis or investing in reverse repurchase agreements) may be considered an issuance of senior securities. Some Funds’ fundamental policy regarding senior securities also restricts the purposes for which, the parties from which, and the amounts that the Fund may borrow without being deemed to be issuing senior securities. The policies may also limit a Fund’s ability to invest while borrowings remain outstanding or require the Fund to segregate assets for investment in when-issued securities.

The Proposed Policy will permit the Funds to issue senior securities to the fullest extent permitted by the 1940 Act and related interpretations, as in effect from time to time, and will not refer to particular investment practices. The Proposed Policy will be interpreted not to prevent collateral arrangements with respect to swaps, options, forward or futures contracts or other clientsderivatives, or the posting of initial or variation margin.

The Adviser has advised the Board that the proposed revisions to the fundamental policy on senior securities are not expected to materially affect the manner in which any Fund’s investment program is being conducted at this time, as reflected in the Fund’s current prospectus and statement of additional information. Before a material change is made in any Fund’s investment strategies in response to this revised policy, the Board will be consulted and the Fund’s prospectus or statement of additional information will be revised to disclose the change, the purpose of the changed strategy and, as applicable, any additional risks.

The Board recommends that you vote “FOR” this Proposal.

Proposal 6 : Revise the fundamental policy relating to underwriting. |

Proposed Policy: The Fund may not underwrite the securities of other issuers except as permitted by (i) the 1940 Act and the rules and regulations thereunder, or other successor law governing the regulation of registered investment companies, or interpretations or modifications thereof by the SEC, SEC staff or other authority of competent jurisdiction, or (ii) exemptive or other relief or permission from the SEC, SEC staff, or other authority of competent jurisdiction. |

| Funds Affected: | Current Policy: |

The Value Line Fund, Inc. Value Line Income and Growth Fund, Inc. Value Line Premier Growth Fund, Inc. Value Line Centurion Fund, Inc. Value Line Core Bond Fund Value Line Strategic Asset Management Trust Value Line Small Cap Opportunities Fund, Inc. Value Line Asset Allocation Fund, Inc. | The Fund may not engage in the underwriting of securities except to the extent that the Fund may be deemed an underwriter as to restricted securities under the Securities Act in selling portfolio securities. |

| Value Line Larger Companies Fund, Inc. | The Fund may not engage in the underwriting of securities. |

The 1940 Act requires all mutual funds to have a fundamental policy about underwriting the securities of other issuers. Under the 1940 Act, a mutual fund is generally considered to be an underwriter if it participates in the public distribution of securities of other issuers by purchasing such securities with the intention of reselling them to others. The 1940 Act permits a mutual fund to have underwriting commitments of up to 25% of its assets under certain circumstances. Currently, those circumstances exist when the amount of the fund’s underwriting commitments, plus the value of the fund’s investments in issuers in which the fund owns more than 10% of the outstanding voting securities, does not exceed 25% of the fund’s assets.

All of the Funds have fundamental policies that prohibit them from underwriting securities entirely. In most cases, the fundamental policy states that the prohibition on underwriting does not apply to the Fund’s sale of restricted portfolio securities to the extent such activity may havebe deemed as underwriting. This is consistent with SEC staff interpretations that a mutual fund’s resale of privately placed securities does not necessarily make the fund an underwriter, notwithstanding the technical definition thereof in federal securities laws.

The Proposed Policy relating to underwriting will permit the Funds to engage in underwriting to the fullest extent permitted by the 1940 Act and related interpretations. This may give a Fund greater flexibility to respond to future investment opportunities, subject to its investment objectives and policies similarstrategies.

The Adviser has advised each Fund’s Board that the proposed revisions to thosethe fundamental policy on underwriting are not expected to materially affect the manner in which the Fund’s investment program is being conducted at this time, as reflected in the Fund’s current prospectus and statement of additional information. Before a material change is made in a Fund’s investment strategies in response to this revised policy, the Fund’s Board will be consulted and the Fund’s prospectus or statement of additional information will be revised to disclose the change, the purpose of the Funds. changed strategy and, as applicable, any additional risks.

The restructured AdviserBoard recommends that you vote “FOR” this Proposal.

Proposal 7 : Reclassify the Fund’s investment objective as non-fundamental. |

Funds Affected: | Current Policy: |

The Value Line Fund, Inc. | The primary investment objective of the Fund is long-term growth of capital. Current income is a secondary objective. |

Value Line Income and Growth Fund, Inc. | The primary investment objective of the Fund is income, as high and dependable as is consistent with reasonable risk. Capital growth to increase total return is a secondary objective. |

| Value Line Larger Companies Fund, Inc. | The sole investment objective of the Fund is to realize capital growth. |

| Value Line Centurion Fund, Inc. | The primary investment objective of the Fund is long-term growth of capital. |

| Value Line Core Bond Fund | The primary investment objective of the Fund is to maximize current income. Capital appreciation is a secondary objective but only when consistent with the Fund’s primary objective. |

| Value Line Strategic Asset Management Trust | The primary investment objective of the Trust is to achieve a high total investment return consistent with reasonable risk. |

| Value Line Small Cap Opportunities Fund, Inc. | The primary investment objective of the Value Line Small Cap Opportunities Fund is to achieve a high total investment return consistent with reasonable risk. |

| Value Line Asset Allocation Fund, Inc. | The investment objective of the Value Line Asset Allocation Fund is long-term growth of capital. |

The 1940 Act does not require a mutual fund’s investment objective to be fundamental. If a fund’s investment objective is non-fundamental, the fund’s prospectus must disclose that it may be changed by the Fund’s Board without obtaining shareholder approval. If a Fund is able to change its investment objective without shareholder approval, the Fund will have flexibility to respond to changing conditions in a manner that the Board deems to be in the best interests of Fund shareholders without the expense and delay of seeking further shareholder approval.

If shareholders of a Fund approve this Proposal, the Fund would continue to be managed subject to the same investment strategies and policies expressed in each Fund’s current prospectus as well as the limitations imposed by the 1940 Act and the rules and interpretive guidance provided thereunder. However, in the future, the Fund’s investment objective may be changed without shareholder approval if the Fund’s Board believes that doing so is in the best interests of shareholders.

The Adviser has informed the Board that reclassifying a Fund’s investment objective as non-fundamental will not affect the manner in which the Fund’s investment program is being conducted at this time, as reflected in the Fund’s current prospectus and statement of additional information. Before a material change is made in a Fund’s investment program in response to this Proposal, the Fund’s Board will be consulted and the Fund’s prospectus or statement of additional information will be revised to disclose the change in investment objective, the purpose of the change and, as applicable, any additional risks.

The Board recommends that you vote “FOR” this Proposal.

Proposals 8 – 15

In addition to the policies required by the 1940 Act to be fundamental, all of the Funds are subject to certain additional, fundamental policies (the “Additional Restrictions”) that are not required by the 1940 Act or other applicable law. For example, many of the Funds have fundamental policies that are merely restatements of limitations set forth in the 1940 Act, and thus are applicable to the Funds regardless of whether such policies are stated as fundamental investment policies. Other fundamental investment policies are more restrictive than SEC staff interpretations or are not required. As explained above, many of these additional policies were adopted to satisfy state regulatory requirements that were preempted in 1996 by NSMIA and are no longer applicable.

The Additional Restrictions consist of all of a Fund’s fundamental investment policies other than those addressed in Proposals 1 through 7 . The Adviser has recommended, and the Board has determined, that the Additional Restrictions covered in Proposals 8 through 15 should be eliminated and that their elimination is consistent with federal securities laws. By reducing the total number of investment policies that can be changed only by a shareholder vote, the Board believes that the Fund will be able to reduce the costs and delays associated with holding future shareholder meetings for the purpose of revising fundamental investment policies that become outdated or inappropriate. Elimination of the Additional Restrictions would also enable the Fund to be managed in accordance with the then-current requirements of the 1940 Act without being constrained by additional and unnecessary limitations. The Board believes that the elimination of the Additional Restrictions is in the best interest of each Fund’s shareholders, as it will provide the Fund with increased flexibility to pursue its investment advisory servicesobjectives and will enhance the Adviser’s ability to manage the Fund’s assets in a changing investment environment.

The Board recommends that you vote “FOR” each of Proposals 8 through 15 for the reasons described above and below ; however, if you want to vote to maintain one or more of the Additional Restrictions, you may vote “AGAINST” any of the Proposals 8 through 15 for your Fund. The Additional Restrictions include, among others, those relating to: (1) diversification; (2) investing in issuers that are “unseasoned” or owned by the Fund’s affiliates; (3) investing in a company for the purpose of exercising control; (4) selling securities short and purchasing securities on margin; (5) joint or joint-and-several trading; and ( 6 ) purchasing warrants. A brief description of the more common Additional Restrictions follows.

At present, all the Funds have Additional Restrictions concerning short sales and purchases on margin. The 1940 Act does not require a fund to have a fundamental policy concerning such investments. However, they are often covered by a fund’s other fundamental policies. For example, to the extent that short sales and purchases on margin are considered “issuing senior securities,” they are governed by a fund’s fundamental policy on senior securities. SEC staff interpretations provide that purchasing securities on margin constitutes the issuance of a senior security, whereas making margin payments in connection with the purchase and sale of futures contracts or options on futures contracts do not, provided the asset segregation requirements are satisfied. With respect to short selling, the staff has taken the position that short sales may constitute the issuance of a senior security if the Fund does not own the security or have an offsetting commitment to obtain it (such as an option or convertible security). If a Fund’s shareholders approve this Proposal, the Fund will be permitted to purchase securities on margin and engage in short sales subject to the Fund’s other investment policies and the limitations of the 1940 Act and applicable interpretations.

Currently, all of the Funds indicate that they are diversified, either by expressly stating they are diversified or having a fundamental policy that tracks the current statutory requirements. All of the Funds also have fundamental policies that either (1) define diversification or (2) impose more stringent restrictions on investment in any given issuer (e.g., 5% of the Fund’s assets or 10% of the issuer’s voting securities). The 1940 Act requires every mutual fund to state whether it is diversified or non-diversified, and requires any change from diversified to non-diversified status to be approved in advance by fund shareholders. However, the 1940 Act does not require a fund to label as “fundamental” its diversified status or the definition of diversification. If a fund labels its diversification policy or definition of diversification as fundamental, and the statutory requirements or interpretations are subsequently relaxed, the fund will be unable to participate in the liberalized rules without shareholder approval. Approving this Proposal would allow a Fund to so participate, but will not change its status from diversified to non-diversified. No vote is being sought to reclassify any Fund’s diversification classification.

Most of the Funds have Additional Restrictions that prohibit the Fund from purchasing securities of issuers that are “unseasoned,” or beneficially owned by officers or directors of the Fund or the Adviser (in excess of a specified threshold). Most of the Funds also have an Additional Restriction that prohibits the Fund from investing in companies for the purpose of exercising control. Such policies were originally adopted by mutual funds to address state requirements in connection with the registration of shares of the fund for sale in a particular state. These state restrictions can be difficult to administer and limit the operation of a fund’s portfolio. As a result of NSMIA, such restrictions are no longer applicable. Finally, most of the Funds have Additional Restrictions that limit their ability to invest in warrants, or that specify how to measure percentage restrictions on investments or apply the rankings from the Value Line rankings systems in the investment process. These Additional Restrictions are either unnecessary or a restatement of current requirements and interpretations under the 1940 Act.

The Adviser has informed the Board that eliminating the Additional Restrictions is not expected to materially affect the manner in which any Fund’s investment program is being conducted at this time, as reflected in the Fund’s current prospectus and statement of additional information. If any of Proposals 8 through 15 are approved, each Fund will continue to be subject to the limitations of the 1940 Act, and any rule, SEC staff interpretation, and exemptive orders granted under the 1940 Act. The Board will be consulted and the Fund’s prospectus or statement of additional information will be revised before any other material change is made in a Fund’s investment funds.strategies in response to the elimination of these Additional Restrictions.

The Board recommends that you vote “FOR” each of the Proposals 8 through 15.

Proposal 8: Remove the fundamental policy relating to margin and short sales. |

| Funds Affected: | Current Policy: |

The Value Line Fund, Inc. Value Line Income and Growth Fund, Inc. Value Line Larger Companies Fund, Inc. Value Line Strategic Asset Management Trust | The Fund may not engage in arbitrage transactions, short sales, purchases on margin or participate on a joint or joint-and-several basis in any trading account in securities except that these prohibitions will not apply to futures contracts or options on futures contracts entered into by the Fund for permissible purposes or to margin payments made in connection with such contracts. |

Value Line Asset Allocation Fund, Inc. Value Line Small Cap Opportunities Fund, Inc. | The Fund may not engage in arbitrage transactions, short sales except as set forth herein, purchases on margin or participate on a joint or joint-and-several basis in any trading account in securities except in connection with the purchase or sale of futures transactions and to deposit or pay initial or variable margin in connection with financial futures contracts or related options transactions. |

Value Line Premier Growth Fund, Inc. Value Line Centurion Fund, Inc. | The Fund may not engage in arbitrage transactions, short sales, purchases on margin or participate on a joint or joint-and-several basis in any trading account in securities. |

| Value Line Core Bond Fund | The Fund may not engage in short sales, except to the extent that it owns other securities convertible into or exchangeable for an equivalent amount of such securities. Such transactions may only occur for the purpose of protecting a profit or in attempting to minimize a loss with respect to convertible securities. No more than 10% of the value of the Fund’s net assets taken at market may at any one time be held as collateral for such sales. |

| Value Line Core Bond Fund | The Fund may not purchase securities on margin except that it may make margin deposits in connection with interest rate futures contracts subject to [the interest rate futures restriction] or participate on a joint or a joint-and-several basis in any trading account in securities. |

Please see pages 22-24 for a description of the rationale for this Proposal.

The Adviser has advised each Fund’s Board that the elimination of the fundamental policy on margin and short sales is not expected to materially affect the manner in which the Fund’s investment program is being conducted at this time, as reflected in the Fund’s current prospectus and statement of additional information. If this Proposal 8 is approved, each Fund will continue to be subject to the limitations of the 1940 Act, and any rule, SEC staff interpretation, and exemptive orders granted under the 1940 Act. Before a material change is made in a Fund’s investment strategies in response to this revised policy, the Fund’s Board will be consulted and the Fund’s prospectus or statement of additional information will be revised to disclose the change, the purpose of the changed strategy and, as applicable, any additional risks.

The Board recommends that you vote “FOR” this Proposal.

Proposal 9: Remove the fundamental policy relating to diversification of investments. |

| Funds Affected: | Current Policy: |

The Value Line Fund, Inc. Value Line Income and Growth Fund, Inc. Value Line Larger Companies Fund, Inc. Value Line Premier Growth Fund, Inc. Value Line Core Bond Fund Value Line Asset Allocation Fund, Inc. Value Line Small Cap Opportunities Fund, Inc. | The Fund may not invest more than 5% of its total assets in the securities of any one issuer or purchase more than 10% of the outstanding voting securities, or any other class of securities, of any one issuer. For purposes of this restriction, all outstanding debt securities of an issuer are considered as one class, and all preferred stock of an issuer is considered as one class. This restriction does not apply to obligations issued or guaranteed by the U.S. Government, its agencies or instrumentalities. |

Value Line Strategic Asset Management Trust Value Line Centurion Fund, Inc. | With respect to securities comprising 75% of the value of its total assets, the Fund will not purchase securities of any one issuer (other than cash, cash items, securities issued or guaranteed by the government of the United States or its agencies or instrumentalities and repurchase agreements collateralized by such U.S. government securities, and securities of other investment companies) if, as a result, more than 5% of the value of its total assets would be invested in securities of that issuer, or the Fund would own more than 10% of the outstanding voting securities of that issuer. |

Please see pages 22-24 for a description of the rationale for this Proposal.

The Adviser has advised each Fund’s Board that the elimination of the fundamental policy on diversification of investments is not expected to materially affect the manner in which the Fund’s investment program is being conducted at this time, as reflected in the Fund’s current prospectus and statement of additional information. If this Proposal 9 is approved, each Fund will continue to be subject to the limitations of the 1940 Act, and any rule, SEC staff interpretation, and exemptive orders granted under the 1940 Act. Before a material change is made in a Fund’s investment strategies in response to this revised policy, the Fund’s Board will be consulted and the Fund’s prospectus or statement of additional information will be revised to disclose the change, the purpose of the changed strategy and, as applicable, any additional risks.

The Board recommends that you vote “FOR” this Proposal.

Proposal 10: Remove the fundamental policy relating to investments in unseasoned issuers. |

| Funds Affected: | Current Policy: |

The Value Line Fund, Inc. Value Line Income and Growth Fund, Inc. Value Line Larger Companies Fund, Inc. Value Line Premier Growth Fund, Inc. Value Line Core Bond Fund Value Line Asset Allocation Fund, Inc. Value Line Small Cap Opportunities Fund, Inc. | The Fund may not invest more than 5% of its total assets in securities of issuers having a record, together with their predecessors, of less than three years of continuous operation. This restriction does not apply to any obligation issued or guaranteed by the U.S. Government, its agencies or instrumentalities. |

Please see pages 22-24 for a description of the rationale for this Proposal.

The Adviser has advised each Fund’s Board that the elimination of the fundamental policy on investing in unseasoned issuers is not expected to materially affect the manner in which the Fund’s investment program is being conducted at this time, as reflected in the Fund’s current prospectus and statement of additional information. If this Proposal 10 is approved, each Fund will continue to be subject to the limitations of the 1940 Act, and any rule, SEC staff interpretation, and exemptive orders granted under the 1940 Act. Before a material change is made in a Fund’s investment strategies in response to this revised policy, the Fund’s Board will be consulted and the Fund’s prospectus or statement of additional information will be revised to disclose the change, the purpose of the changed strategy and, as applicable, any additional risks.

The Board recommends that you vote “FOR” this Proposal.

Proposal 11: Remove the fundamental policy on investments in issuers owned by the Fund’s trustees or officers. |

| Funds Affected: | Current Policy: |

The Value Line Fund, Inc. Value Line Income and Growth Fund, Inc. Value Line Larger Companies Fund, Inc. Value Line Premier Growth Fund, Inc. Value Line Core Bond Fund Value Line Asset Allocation Fund, Inc. Value Line Small Cap Opportunities Fund, Inc. | The Fund may not purchase the securities of any issuer if, to the knowledge of the Fund, those officers and directors of the Fund and of the Adviser, who each owns more than 0.5% of the outstanding securities of such issuer, together own more than 5% of such securities. |

Please see pages 22-24 for a description of the rationale for this Proposal.

The Adviser has advised each Fund’s Board that the elimination of the fundamental policy on investments in issuers whose shares are owned by the Fund’s trustees or officers is not expected to materially affect the manner in which the Fund’s investment program is being conducted at this time, as reflected in the Fund’s current prospectus and statement of additional information. If this Proposal 11 is approved, each Fund will continue to be subject to the limitations of the 1940 Act, and any rule, SEC staff interpretation, and exemptive orders granted under the 1940 Act. Before a material change is made in a Fund’s investment strategies in response to this revised policy, the Fund’s Board will be consulted and the Fund’s prospectus or statement of additional information will be revised to disclose the change, the purpose of the changed strategy and, as applicable, any additional risks.

The Board recommends that you vote “FOR” this Proposal.

Proposal 12: Remove the fundamental policy relating to purchasing securities for the purpose of exercising control. |

| Funds Affected: | Current Policy: |

The Value Line Fund, Inc. Value Line Income and Growth Fund, Inc. Value Line Larger Companies Fund, Inc. Value Line Premier Growth Fund, Inc. Value Line Core Bond Fund Value Line Asset Allocation Fund, Inc. Value Line Small Cap Opportunities Fund, Inc. | The Fund may not purchase securities for the purpose of exercising control over another company. |

Please see pages 22-24 for a description of the rationale for this Proposal.

The Adviser has advised each Fund’s Board that the elimination of the fundamental policy on not purchasing securities for the purpose of exercising control over another company is not expected to materially affect the manner in which the Fund’s investment program is being conducted at this time, as reflected in the Fund’s current prospectus and statement of additional information. If this Proposal 12 is approved, each Fund will continue to be subject to the limitations of the 1940 Act, and any rule, SEC staff interpretation, and exemptive orders granted under the 1940 Act. Before a material change is made in a Fund’s investment strategies in response to this revised policy, the Fund’s Board will be consulted and the Fund’s prospectus or statement of additional information will be revised to disclose the change, the purpose of the changed strategy and, as applicable, any additional risks.

The Board recommends that you vote “FOR” this Proposal.

| Proposal 13: Remove the fundamental policy relating to warrants. |

|

| Funds Affected: | Current Policy: |

The Value Line Fund, Inc. Value Line Income and Growth Fund, Inc. Value Line Larger Companies Fund, Inc. Value Line Premier Growth Fund, Inc. Value Line Core Bond Fund Value Line Asset Allocation Fund, Inc. Value Line Small Cap Opportunities Fund, Inc. | The Fund may not invest more than 2% of the value of its total assets in warrants (valued at the lower of cost or market), except that warrants attached to other securities are not subject to these limitations. |

Please see pages 22-24 for a description of the rationale for this Proposal.

The Adviser has advised each Fund’s Board that the elimination of the fundamental policy on warrants is not expected to materially affect the manner in which the Fund’s investment program is being conducted at this time, as reflected in the Fund’s current prospectus and statement of additional information. If this Proposal 13 is approved, each Fund will continue to be subject to the limitations of the 1940 Act, and any rule, SEC staff interpretation, and exemptive orders granted under the 1940 Act. Before a material change is made in a Fund’s investment strategies in response to this revised policy, the Fund’s Board will be consulted and the Fund’s prospectus or statement of additional information will be revised to disclose the change, the purpose of the changed strategy and, as applicable, any additional risks.

The Board recommends that you vote “FOR” this Proposal.

Proposal 14: Remove the fundamental policy relating to measurement of percentage restrictions on investments. |

| Funds Affected: | Current Policy: |

The Value Line Fund, Inc. Value Line Income and Growth Fund, Inc. Value Line Premier Growth Fund, Inc. Value Line Strategic Asset Management Trust Value Line Centurion Fund, Inc. | If a percentage restriction used in this Statement of Additional Information or the Prospectus is adhered to at the time of investment, a later change in percentage resulting from changes in values or assets will not be considered a violation of the restriction except for [the borrowing restriction] and the restriction on illiquid securities. |

Value Line Larger Companies Fund, Inc. | If a percentage restriction used in this Statement of Additional Information or the Prospectus is adhered to at the time of investment, a later change in percentage resulting from changes in values or assets will not be considered a violation of the restriction. |

| Value Line Core Bond Fund | If a percentage restriction used in this Statement of Additional Information or the Prospectus is adhered to at the time of investment, a later change in percentage resulting from changes in values or assets will not be considered a violation of the restriction (other than investment in illiquid securities and the limitation on borrowing). |

Value Line Asset Allocation Fund, Inc. Value Line Small Cap Opportunities Fund, Inc. | If a percentage restriction used in this Statement of Additional Information or the Prospectus is adhered to at the time of investment, a later change in percentage resulting from changes in values or assets will not be considered a violation of the restriction except for [the borrowing restriction] and the restriction on illiquid securities, in which case the Fund will take prompt action to reduce borrowings or dispose of illiquid securities. |

Please see pages 22-24 for a description of the rationale for this Proposal.

The Adviser has advised each Fund’s Board that the elimination of the fundamental policy on use of investment restrictions is not expected to materially affect the manner in which the Fund’s investment program is being conducted at this time, as reflected in the Fund’s current prospectus and statement of additional information. If this Proposal 14 is approved, each Fund will continue to be subject to the limitations of the 1940 Act, and any rule, SEC staff interpretation, and exemptive orders granted under the 1940 Act. Before a material change is made in a Fund’s investment strategies in response to this revised policy, the Fund’s Board will be consulted and the Fund’s prospectus or statement of additional information will be revised to disclose the change, the purpose of the changed strategy and, as applicable, any additional risks.

The Board recommends that you vote “FOR” this Proposal.

Proposal 15: Remove the fundamental policy relating to the use of Value Line ranking systems. |

| Funds Affected: | Current Policy: |

The Value Line Fund, Inc. Value Line Income and Growth Fund, Inc. Value Line Larger Companies Fund, Inc. Value Line Asset Allocation Fund, Inc. | Reliance upon the Ranking System, whenever feasible, is a fundamental policy of the Fund which may not be changed without shareholder approval. |

| Value Line Centurion Fund, Inc. | In addition, it is a fundamental policy of the Fund to rely, whenever feasible, on the Value Line Timeliness™ Ranking System. |

| Value Line Strategic Asset Management Trust | In addition, it is a fundamental policy of the Trust to rely, whenever feasible, on the Value Line Timeliness™ Ranking System and the Value Line Performance™ Ranking System. |

Please see pages 22-24 for a description of the rationale for this Proposal.

The Adviser has advised each Fund’s Board that the elimination of the fundamental policy on the use of ranking systems is not expected to materially affect the manner in which the Fund’s investment program is being conducted at this time, as reflected in the Fund’s current prospectus and statement of additional information. If this Proposal 15 is approved, each Fund will continue to be subject to the limitations of the 1940 Act, and any rule, SEC staff interpretation, and exemptive orders granted under the 1940 Act. Before a material change is made in a Fund’s investment strategies in response to this revised policy, the Fund’s Board will be consulted and the Fund’s prospectus or statement of additional information will be revised to disclose the change, the purpose of the changed strategy and, as applicable, any additional risks.

The Board recommends that you vote “FOR” this Proposal.

THE BOARD UNANIMOUSLY RECOMMENDS

THAT YOU APPROVE EACH PROPOSAL DESCRIBED ABOVE

OTHER INFORMATION

Trustees and Executive Officers

The Trustees of each Fund are Mitchell E. Appel, Joyce E. Heinzerling, Francis C. Oakley, David H. Porter, Paul Craig Roberts, Nancy-Beth Sheerr, and Daniel S. Vandivort. The executive officers are Mitchel E. Appel, Michael J. Wagner and Emily D. Washington.

Other Service Providers.

As of July 31, 2010, the shareholders identified in Appendix I were known by the Funds to own, beneficially or of record, more than 5% of any class of outstanding shares of a Fund

Investment Adviser.

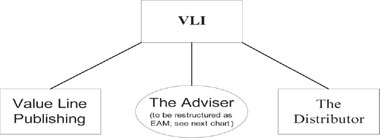

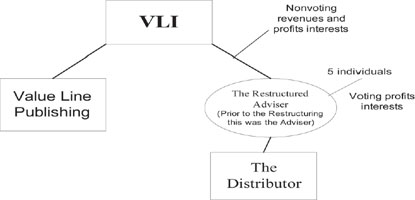

The Adviser serves as the investment adviser to each Fund. The principal business address of the Adviser is 220 East 42nd Street, New York, NY 10017. The Adviser is currently a wholly-owned subsidiary of VLI, a New York company also located at 220 East 42nd Street, New York, NY 10017, which in turn is a subsidiary of Arnold Bernhard & Co., Inc., a New York corporation controlled by Jean Bernhard Buttner. VLI has stated that, after giving effect to the Restructuring, Mrs. Buttner will no longer directly or indirectly control the restructured Adviser or the Distributor or own any of their voting securities. As of July 31, 2010, the Adviser provided investment advisory services for approximately $2.1 billion of assets. The name and principal occupation of directors and principal executive officers of the Adviser are provided in Appendix J attached to this Proxy Statement.

Other Service Providers.

Principal Underwriter. EULAV Securities Inc.LLC is the principal underwriter of the Funds. EULAV Securities Inc.’sLLC’s principal business address is 220 East 427 Times Square, 21nd stStreet, Floor, New York, NY 10017.New York 10036-6524.

Administrator. State Street Bank and Trust Company (“State Street”) provides certain bookkeeping, accounting and administrative services for the Funds. State Street, whose address is 225 Franklin Street, Boston, MAMassachusetts 02110, also acts as the Funds’ custodian, transfer agent and dividend-paying agent. As custodian, State S treetStreet is responsible for safeguarding the Funds’ cash and securities, handling the receipt and delivery of securities and collecting interest and dividends on the Funds’ investments. As transfer agent and dividend-paying agent, State Street effects transfers of Fund shares by the registered owners and transmits payments for dividends and distributions declared by the Fund. Boston Financial Data Services, Inc., a State Street affiliate, whose address is 330 West 9thStreet, Kansas City, MOMissouri 64105 (the “Proxy Solicitation Firm”), provides certain transfer agency functions to the Funds as an agent for State Street.

Independent Registered Public Accountants. PricewaterhouseCoopers LLP (“PWC”), 300 Madison Avenue, New York, NY 10017, serves asShareholder Approval.

As required by the independent registered public accounting firm1940 Act, to become effective with respect to a particular Fund, each Proposal must be approved by (a) the vote of 67% of the Fund’s shares present at the Meeting if more than 50% of the outstanding shares of that Fund are present, or (b) the vote of more than 50% of the outstanding shares of that Fund, whichever is less.

A quorum of shareholders of your Fund is necessary to hold a valid Meeting. A quorum will exist at the Meeting if a majority of the shares of your Fund who are entitled to vote on the Record Date are present in person or by proxy. In the event that a quorum is not present, or if a quorum is present but sufficient votes to approve a Proposal are not received, the duly appointed proxies may propose one or more adjournments of the Meeting to permit further solicitation of proxies with respect to a Proposal. In case any such adjournment is proposed, the proxies will vote for each Fund. Representativesthose proxies which they are entitled to vote for a Proposal in favor of PWCadjournment, and will notvote those proxies required to be voted against a Proposal against adjournment. At any such adjourned meeting at which a quorum shall be present, any business may be transacted which might have been transacted at either Meeting.the meeting originally called. A shareholder vote may be taken on one or more Proposals prior to such adjournment if sufficient votes for a Proposal’s approval have been received and it is otherwise appropriate. Any such vote will be final regardless of whether such Meeting is adjourned with respect to any other Proposal. A Meeting may be held for any Fund for which a quorum is present irrespective of whether a quorum is achieved for other Funds.

The Funds’ Audit Committee has established certain pre-approval policies and procedures relating to the engagement of the Funds’ independent registered public accountants to provide non-audit services to the Funds or to the Funds’ investment adviser, or the Funds’ investment adviser’s affiliates, that provides ongoing services to the Funds if the engagement relat es directly to the operations and financial reporting of the Funds (the “Non-Audit Services Pre-Approval Policies”).

Independence of PWC . The Audit Committee has considered whether the provision of non-audit services rendered to the Funds’ investment adviser and any Adviser Affiliate that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X, if any, are compatible with maintaining PWC ’s independence, and has determined that the provision of these services does not compromise PWC ’s independence.

Disclosure of Fees. Appendix K sets forth for each Fund’s two most recent fiscal years, the fees billed by PWC for all audit and non-audit services provided directly to the Fund and adviser affiliates. The fee information in Appendix K is presented under the following captions:| | |

| (a) Audit Fees—fees related to the audit and review of the financial statements included in annual reports and registration statements, and other services that are normally provided in connection with statutory and regulatory filings or engagements, including out-of-pocket expenses. |

| (b) Audit-Related Fees—fees related to assurance and related services that are reasonably related to the performance of the audit or review of financial statements, but not reported under “Audit Fees,” including accounting consultations, agreed-upon procedure reports, attestation reports, comfort letters, out-of-pocket expenses and internal control reviews not required by regulators. |

| |

| (c) Tax Fees—fees associated with tax compliance, tax advice and tax planning, including services relating to the filing or amendment of federal, state or local income tax returns, regulated investment company qualification reviews, tax distribution and analysis reviews and miscellaneous tax advice. |

| |

| (d) All Other Fees—fees for products and services provided to the Fund and adviser affiliates other than those reported under “Audit Fees,” “Audit-Related Fees” and “Tax Fees.” |

Other Business at the Meetings .

No other matter may come before either Meeting other than as stated in this Proxy Statement. In connection with any proposal to adjourn a Meeting to permit the continued solicitation of proxies in favor of the Election of Directors Proposal or the Investment Advisory Proposal (as applicable) , proxies that do not contain specific restrictions to the contrary will be voted on such matters in a ccordance with the judgment of the persons named as proxies in the enclosed Proxy Cards.

If you do not plan to attend the Meetings in person, please complete, sign, date,Abstentions and return the enclosed Proxy Cards or cast your vote by touchtone phone or via the Internet promptly. Even if you do plan to attend a Meeting, please so note where provided and return the Proxy Cards promptly.

Future Shareholder Proposals.

Pursuant to rules adopted by the SEC under the 1934 Act, shareholders may request for inclusion in the Board’s proxy statement for future shareholder meetings certain proposals for actions which they intend to introduce at such meeting. Any shareholder proposals must be presented a reasonable time before the proxy materials for the next meeting are sent to shareholders. The submission o f a proposal does not guarantee its inclusion in the Funds’ proxy statement and is subject to limitations under the 1934 Act. Because the Funds do not hold regular meetings of shareholders, no anticipated date of the next meeting can be provided.

Voting of Proxies.

Shares represented by properly given proxies and received by the Secretary of the Funds prior to a Meeting, unless revoked before or at such Meeting, will be voted according to the shareholder’s instructions. If you sign a proxy but do not fill in a vote, your shares will be voted in favor of each of the Nominees for Director and in favor of each of the other Proposals. If any other bus iness properly comes before such Meeting, your shares will be voted at the discretion of the persons named as proxies on the enclosed Proxy Cards .

A proxy with respect to shares held in the name of two or more persons will be valid if executed by one of them, unless at or prior to the exercise of such proxy, the Funds receive specific written notice to the contrary from one of such persons.

A proxy purporting to be exercised by or on behalf of a shareholder will be valid unless challenged at or prior to its exercise. The burden of proving the invalidity of the proxy will rest with the person seeking to challenge it.

Revocation of Proxies; Counting of Votes.

Any shareholder giving a proxy may revoke it at any time before it is exercised by: (i) submitting to the Funds a written notice of revocation; (ii) submitting to the Funds a subsequently dated and executed proxy; (iii) attending the Meeting to which the proxy relates and voting in person; or (iv) notifying the Funds of the revocation by calling the toll-free number on the Proxy Cards. Proxie s voted by telephone or through the Internet may be revoked at any time before they are voted in the same manner that proxies voted by mail may be revoked.

At Meeting #1, “broker non-votes” (i.e., proxies from brokers or nominees indicating that such persons have not received instructions from the beneficial owners or other persons entitled to vote shares as to a particular matter with respect to which the brokers or nominees do not have discretionary power to vote) will not b ebe counted for or against any proxy to which they relate, but will be counted as votes present at the Meeting for purposes of determining whether a quorum is present. AbstentionsAs a result, abstentions and broker non-votes will generally have the effect of a vote against the Investment Advisory Proposal and will not affect the vote on the Election of Directors Proposal.

Quorum Requirements.Voting of Proxies; Revocation of Proxies.

A quorumShares represented by properly given proxies and received by the Funds prior to the Meeting, unless revoked before or at such Meeting, will be voted according to the shareholder’s instructions. If you sign a proxy but do not fill in a vote, your shares will be voted in favor of shareholders of a Fund is necessary to hold a valid meeting for that Fund. The quorum requirement for each Fund is set forth in Appendix D.

A quorum will exist at a Fund’s Meeting #1 or Meeting #2 if the percentage of shareholders,Proposal. Except as listeddiscussed above who are entitled to vote on the Record Date with respect to each Fund are present in person or by proxy ata proposed adjournment, if any other business properly comes before such Meeting, . Inyour shares will be voted at the event that a quorum is not present, or if a quorum is present but sufficient votes to approve a Proposal are not received,discretion of the duly appointedpersons named as proxies m ay propose one or more adjournments of such Meeting to permit further solicitation of proxieson the enclosed proxy card.

A proxy with respect to shares held in the Proposal. In casename of two or more persons will be valid if executed by one of them, unless at or prior to the exercise of such proxy, the Funds receive specific written notice to the contrary from one of such persons. A proxy purporting to be exercised by or on behalf of a shareholder will be valid unless challenged at or prior to its exercise. The burden of proving the invalidity of the proxy will rest with the person seeking to challenge it.

Any shareholder giving a proxy may revoke it at any such adjournmenttime before it is proposed,exercised by: (i) submitting to the proxies will vote for those proxies whichFunds a written notice of revocation; (ii) submitting to the Funds a subsequently dated and executed proxy; (iii) attending the Meeting and voting in person; or (iv) notifying the Funds of the revocation by calling the toll-free number on the proxy card. Proxies voted by telephone or through the Internet may be revoked at any time before they are entitled to vote forvoted in the Proposal in favor of adjournment, and will vote thosesame manner that proxies required to be voted against the Proposal against adjournment. At any such adjourned meeting at which a quorum shall be present, any businessby mail may be transacted which might have been transacted at the meeting originally called. A shareholder vote may be taken on one or more of the Proposals prior to such adjournment if sufficient votes for its approval have been received and it is otherwise appropriate. Any such vote will be final regardless of whether such Meeting is adjourned with respect to any other Proposal. A Meeting may be held for any Fund for which a quorum is present irrespective that a quorum may not be achieved for such Meeting of any other Fund.

Solicitation of Proxies and Payment of Expenses.